The Nigerian National Petroleum Corporation (NNPC) has confirmed that the nation’s economy loses N2 billion daily to fuel smuggling.

This comes as the Federal Government said its border closure decision had led to a reduction in the demand for the product, even as prices for rice and frozen foods keep rising due to restricted supplies.

Indeed, the national oil company submitted that it had witnessed a significant drop in Premium Motor Spirit (popularly called petrol) evacuation from the depots since August 22.

There had been concerns about the nation’s daily fuel demand, especially when the amount used to offset subsidy payments rose over projected income.

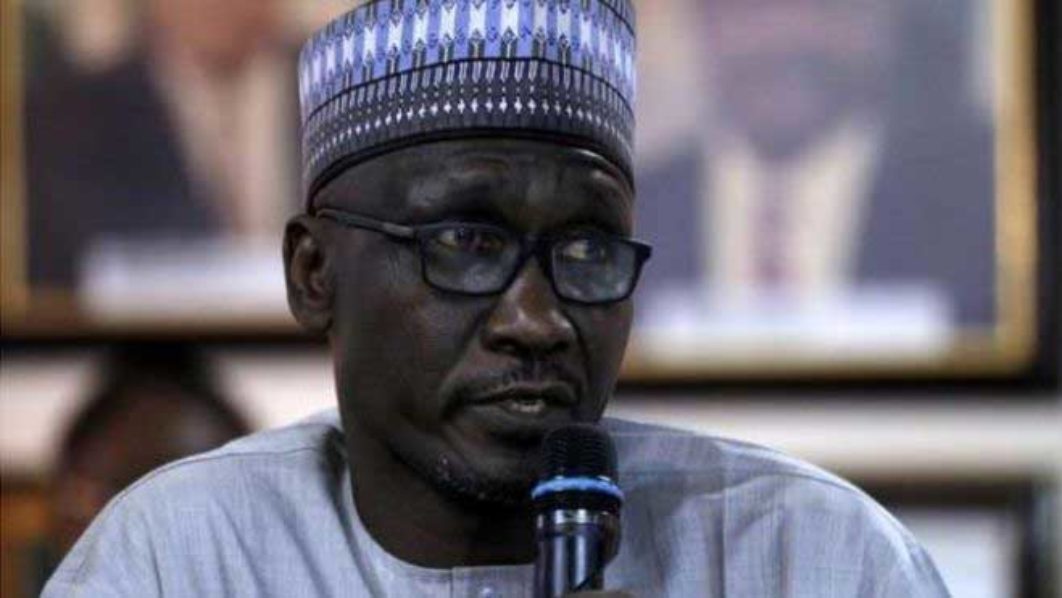

NNPC Group Managing Director, Mele Kyari, in a tweet, said the drop might not be unconnected with the border restriction policy and other interventions of the security agencies aimed at curbing smuggling.

Hitherto, petrol smugglers, according to the corporation, were believed to be stealing and selling about 10 million litres of the commodity daily to neighbouring countries.

With petrol subsidised in Nigeria, as against the deregulated prices in fellow nations, the development provides an incentive for perpetrators of the economic sabotage.

For rice, poultry products and frozen foods in most local markets, their prices have gone up astronomically. While a bag of rice currently goes for N22,000 from N16,000 , a kilogramme of turkey that was N1,400 now sells for N2,000.

The NNPC boss noted that fuel smuggling was thriving due to the price advantage, since the product sells less in Nigeria.

Reacting to the restriction on the gateways, the Lagos Chamber of Commerce and Industry (LCCI) said government ought to be more strategic in dealing with problems of this nature.

Its Director-General, Muda Yusuf, said: “The border closure is a simplistic solution to a complicated, broader and multidimensional problem. We should develop the culture of tackling the causes of problems, not fighting the symptoms. This is the way to solve a problem sustainably.”

Besides, a United States Southern District Court of New York has discharged the NNPC of paying $2.7 billion in a case involving ESSO Exploration and Production Nigeria Limited and Shell Nigerian Exploration and Production Company Limited.

This comes few weeks after a United Kingdom court awarded a judgment debt of $9.6 billion against the Federal Government.

The state oil firm had earlier disclosed that it recorded a $1.6 billion savings from the arbitration between its flagship upstream subsidiary, the Nigerian Petroleum Development Company (NPDC), and Atlantic Energy Drilling Concept Nigeria Limited, bringing the succour to $4.3 billion.

In a February 1, 2019 hearing in the protracted litigation arising from the disputes between NNPC and ESSO regarding the implementation of the Production Sharing Contract (PSC) of May 21, 1993 and covering OPL 209 and OML 133, ESSO had referred its claims to arbitration in Nigeria and obtained an award of $1.799 billion on October 24, 2011, with a year interest running at London Interbank Offered Rate (LIBOR) at four per cent.

But the judgment was challenged with an application that there was no award for the U.S. court to enforce, as a competent court in Nigeria had aside the sought damages.

A statement yesterday by the corporation’s spokesperson, Ndu Ughamadu, said the decision was contested on the ground that there was no legal basis for the American court to exercise jurisdiction over the NNPC since it had no presence in the United States neither does it own property nor conduct its businesses therein.

In a related development, a coalition of civil society groups yesterday opposed the payment of the $9.6 billion judgment debt awarded against Nigeria.

Convener of the Guardians of Democracy and Development, Transparency and Accountability, Solomon Adodo, who spoke on behalf of the group, communicated the position in Abuja.

2 Comments