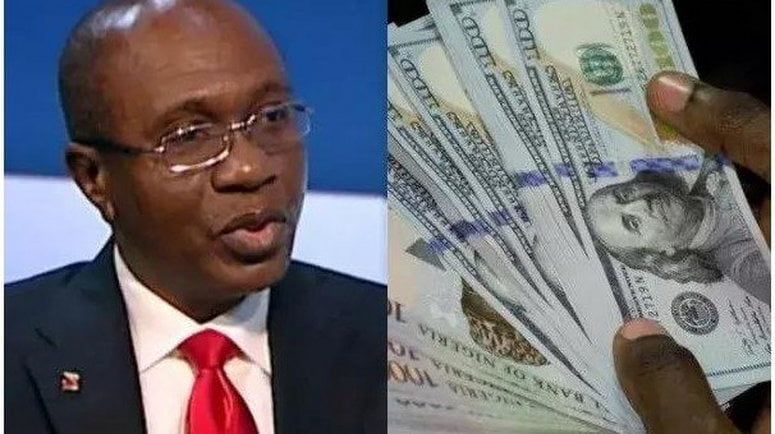

Foreign reserves have risen to $34.65bn within eleven days, latest figures from the Central Bank of Nigeria have indicated.

The report specifically showed that the foreign reserves rose by $1.22bn from $33.42bn as of April 29, 2020 to $34.65bn on May 11.

The reserves had slipped into a decline after hitting a high of $45.17bn on June 11, 2019, losing $11bn at $33.89bn as of April 28, 2020.

The Central Bank Governor, Mr Godwin Emefiele, during the last Monetary Policy Committee meeting of the banking sector, reiterated the need for government to urgently reduce reliance on oil revenue by gradually diversifying the economy and improving tax collection.

On the domestic front, he said, available data on key macroeconomic variables indicated the likelihood of subdued output growth for the Nigerian economy in 2020.

He said, “Based on the current downturn in oil prices, staff projections indicate that output in 2020 would be less than earlier envisaged.

“The major downside risks to this outlook, however, include the continued spread of COVID-19; further decline in crude oil prices and the reduction in accretion to external reserves; reduced government revenue leading to weak aggregate demand; declining non-oil receipts; as well as infrastructural and security challenges.”

Emefiele also said the headwinds would, however, be partly mitigated by the timely and effective response of the monetary and fiscal authorities in containing the spread of the COVID-19 infection, and the recalibration as well as adjustment of the 2020 federal budget to the revised thresholds.

The CBN governor emphasised pegging expenditure to critical sectors of the economy, adoption of a new fiscal regime to encourage the build-up of fiscal buffers; sustained CBN interventions in selected sectors; and enhanced flow of credit to the real sector and deliberate policies to diversify the economy.

PUNCH.

2 Comments