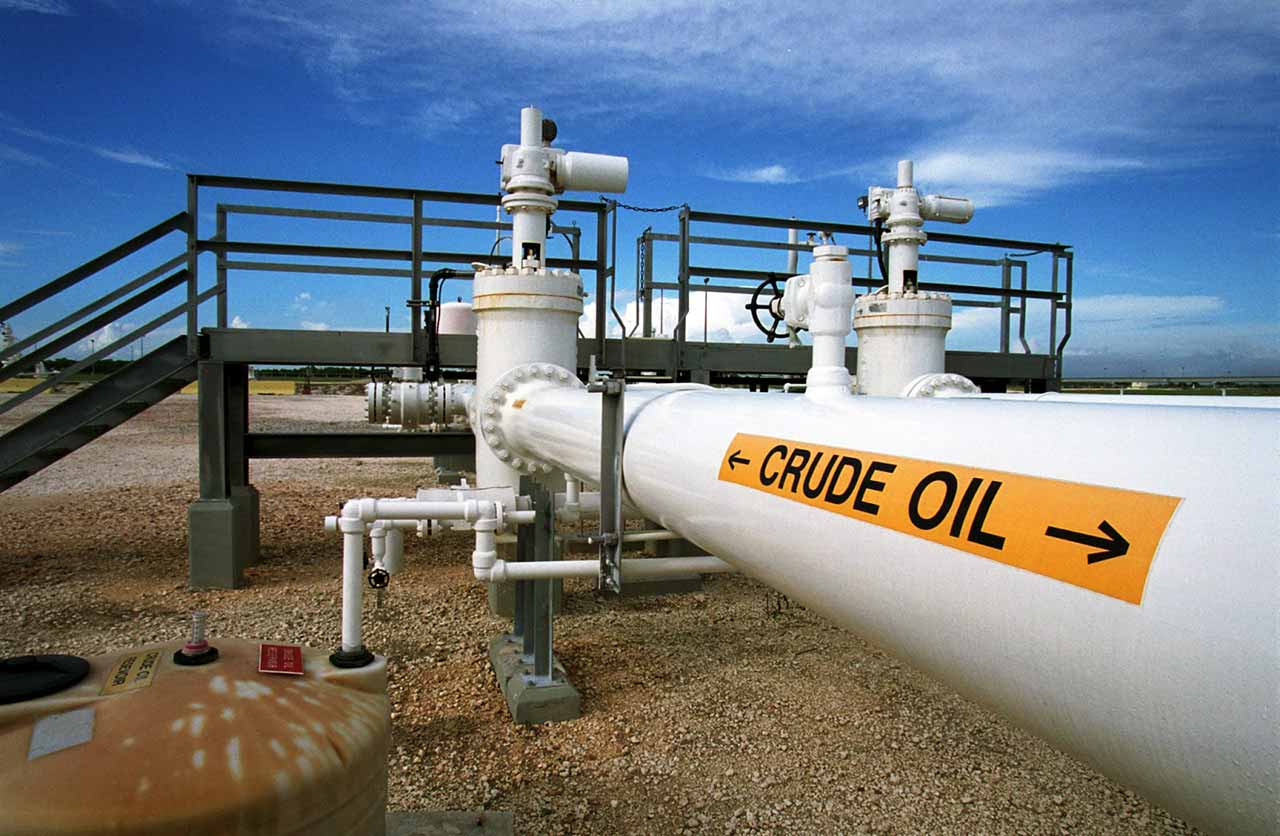

Brent, the international benchmark for crude oil, rose to a high of $84/barrel on Wednesday, fuelling speculations that Nigeria might witness another hike in the pump price of Premium Motor Spirit, popularly called petrol, in the coming weeks.

Crude oil, which is a major determinant for refined petroleum products’ prices, hovered between $75 and $78/barrel for over a month, but peaked in price on Wednesday, after witnessing similar highs since last week.

While oil marketers told our correspondent, on Wednesday, that the rise in crude oil price coupled with the increase in exchange rates would warrant further hike in petrol price, the Nigerian National Petroleum Company Limited maintained its stance on selling PMS at the market price.

Although other oil marketers have commenced the importation of petrol into Nigeria, NNPCL is still the major importer of the commodity, being the supplier of last resort.

The Major Oil Marketers Association of Nigeria explained that the international price of crude oil and the exchange rate constituted the largest components of the cost build-up for PMS, accounting for over 80 per cent.

“The rise in crude oil price and increase in forex will definitely raise the cost of petrol since the market has been liberalised. This is what you get in a deregulated market,” the Secretary, the Independent Petroleum Marketers Association of Nigeria, Abuja-Suleja, Mohammed Shuaibu, told our correspondent.

This made the cost of petrol jump from N198/litre in May to over N500/litre in June, before increasing to over N600/litre in July.

But with the latest rise in crude oil price and fluctuations in forex, marketers anticipate further hike in the pump price of petrol.

The Chief Corporate Communications Officer, NNPCL, Garba-Deen Mohammad, insisted that since PMS had been subsidised, the oil firm would maintain the sale of petrol at the prevailing market price, explaining that the Federal Government was the one bearing the subsidy burden in the past.

He said, “It is the Federal Government that no longer has to bear the cost of subsidy. The Federal Government was bearing it and NNPC was going through under-recovery, because NNPC must import PMS and sell it at a price that is subsidised.

“And because of that, NNPC cannot say we will not import PMS since we will not sell it at the right price. This is because one of the fundamental mandates of NNPC is to ensure that there is energy security. So NNPC must import and must sell at a price that the government approves.”

2 Comments