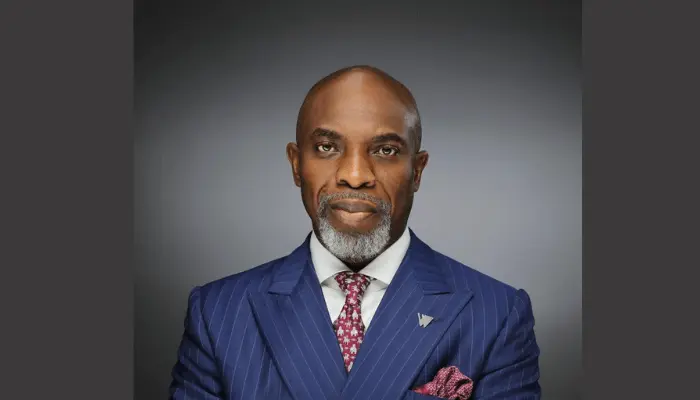

Wema Bank’s MD/CEO, Moruf Oseni has stressed the need to provide a platform to address fundamental issues impacting Micro, Small and Medium Enterprises (MSMEs) and Women in Nigeria, while also focusing on climate issues.

Oseni, spoke at the Bank’s Donor Roundtable, tagged: “Innovative Financing: Gender-lens and climate resilient solution, held in Lagos.

He bemoaned that MSMEs, despite being the largest employers of labor across the country, they continue to suffer from problems of access to capital, development of critical managerial skills, access to markets, logistics challenges, a slowing economy, and heightened inflation which ensures that most of them do not grow or even survive.

The CEO lamented the complication of climate change, saying it spurred significant shifts in human behavior, while adding further strain to societal dynamics.

For him, to address these problems, there is a need to create bespoke and innovative financing models that bridge funding disparities.

Oseni stressed the need to ensure that these funding options offer flexibility and ease of access to the unique needs of Small and Medium Enterprise (SMEs).

He said: “The world we face is a transformed one. The COVID-19 pandemic shut millions of people inside their homes and completely disrupted the global economy and the supply chain that underpins it. Global growth has been firmly below double digits for the last few years.

“climate change have also unleashed a flood of migrants from the developing world into more developed countries. Pockets of conflict on the global stage have further exacerbated the growth problems we were already experiencing.

“The burden of this transformed world disproportionately falls on the youth and women in particular who face higher unemployment rates across every strata of society.

“We must ensure that funding options offer flexibility and ease of access to the unique needs of SMEs.”

Co-founder, Africa Sustainable Trade, Dr. AMA Onyerinma, stressed the need to tackle the issues of gender inequality, noting that there is a challenge for women in entrepreneur.

Over the years, Wema Bank has sustained a reputable history of empowering and supporting its customers financially, digitally, and in every other significant way. In 2023, the bank disbursed over N28 billion in loans to businesses across Nigeria.

2 Comments