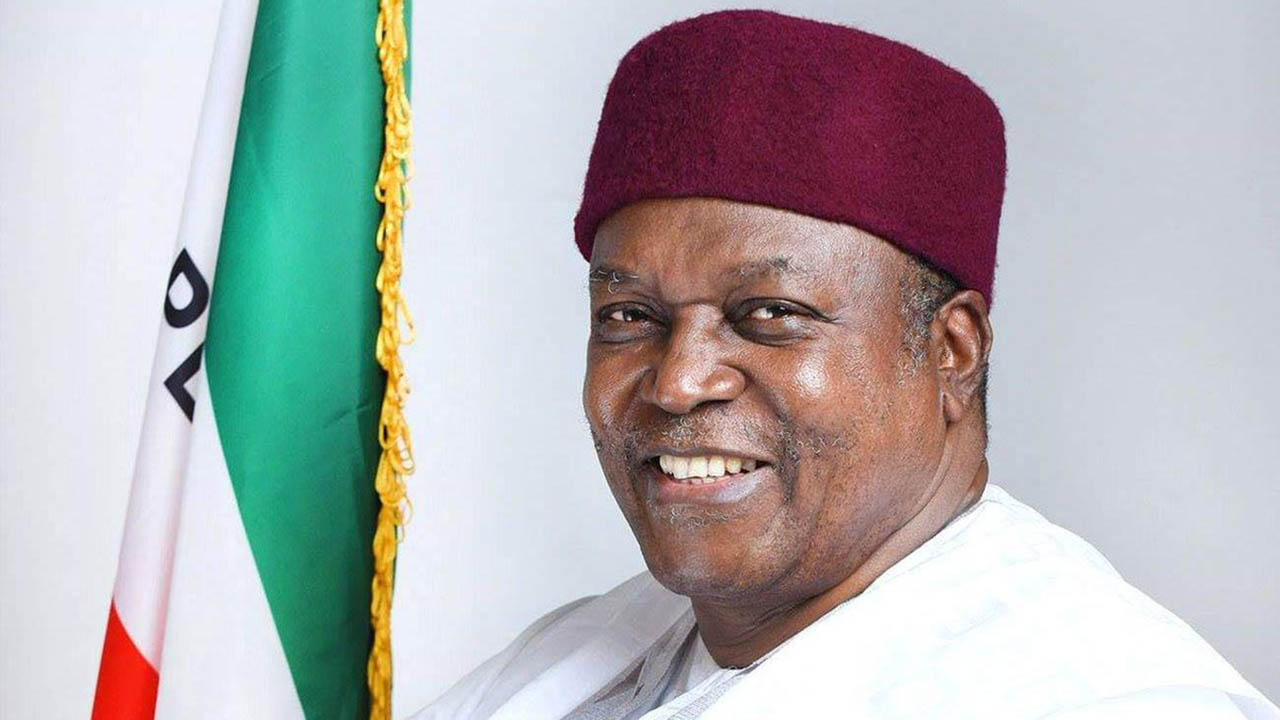

The Federal Government is now implementing measures to significantly reduce the cost of Liquefied Petroleum Gas, popularly called cooking gas, the Minister of State for Petroleum Resources (Gas), Ekperikpe Ekpo, announced on Tuesday.

Ekpo disclosed this at a stakeholders’ consultative meeting in Abuja that had international and indigenous oil companies, major and independent oil marketers, LPG dealers, regulators, among other players, in attendance.

This came as gas producers told journalists on the sidelines of the event that the total gas debts to gas producing firms was now $1.3bn, as this was negatively impacting on investments in the sector.

In his address during the meeting, Ekpo said, told his audience that the Federal Government had decided to focus on three priority areas to ensure sustainable development in the country’s gas sector.

Part of this, according to the minister, include the implementation of measures that would cut down cooking gas price significantly.

He said, “We will intensify efforts to increase upstream gas production, to bridge the significant gas supply gaps which continue to hamper our strategic economic sectors (gas to power and gas-based industries, as well as gas for export).

“It is imperative that we work together to unlock more resources to provide gas for power, gas-based industries, LNG export, and domestic use, fostering economic growth, ensuring energy security and eradicating poverty, which is a cardinal objective of President Bola Tinubu’s Renewed Hope Agenda.

“We will prioritise the domestication and penetration of LPG and implement measures to significantly reduce the price of cooking gas for our people, ensuring it becomes more accessible, available, and affordable for our citizens.”

The cost of cooking gas in Nigeria has been steadily increasing in recent months due to various factors like global energy price fluctuations and local supply chain challenges.

Although the cost of the commodity vary across states, the price of the regular 12.5kg gas is currently between N12,500 and N13,500 depending on the area of purchase. It was less than N8,000 some months ago.

Many Nigerians are switching to alternative cooking fuels like charcoal and firewood due to the rising cost of gas.

The government is implementing initiatives like the Gas Supply Stabilization Fund to improve gas affordability and stabilise the market, as the gas minister assured his audience on Tuesday that steps were being taken to reduce cooking gas price.

Ekpo further stated that “we are dedicated to the completion of major gas midstream infrastructure and projects, including the AKK Gas Pipeline Project, the OB3 Gas Pipeline Project, and the ANOH Project, as well as enabling flagship projects like the Brass Methanol Project, to enhance the efficiency and capacity of our gas sector.”

He described Nigeria as one of the leading gas-rich countries in the world but had yet to unlocked the full potential of this valuable resource.

“This underperformance can be attributed to issues such as gas flaring, inadequate infrastructure, pricing concerns, policy and regulatory gaps, limited funding, environmental concerns, the growing urgency for a smooth energy transition as well as a lack of comprehensive gas development blueprint.

“It is my belief that by acknowledging these realities, we can proffer solutions. I am confident that the discussions and deliberations over the course of this engagement will not only lead to developing a comprehensive roadmap but will also strengthen the bonds between the public and private sectors.

“Together, we shall overcome challenges, unlock opportunities, and build a gas sector that stands the test of time and provides our nation the platform to be the regional industrial hub and powerhouse it is meant to be,” Ekpo stated.

$1.3bn gas debts

Speaking to journalists on the sidelines of the meeting, the Managing Director, Shell Petroleum Development Company of Nigeria, Osagie Okunbor, said gas producers were currently owed $1.3bn.

Okunbor, who spoke on behalf of the Oil Producers Trade Section, a body made up of international oil companies, said this was hampering investments in the sector and should be addressed.

“At the last count we are owed about $1.3bn for gas that has been produced and sold in the past. If you are owed that kind of money across board, you can imagine the impact. I work for Shell and my colleague here with me works for Chevron, and I think between us we are owed probably the largest share of this.

“So it doesn’t create the environment for you to want to put in more and it is a key issue for the Decade of Gas discussions that we are having. How do we crack this problem so that you incentivise people to make investments.

“How do we build the infrastructure? You heard the minister talk about key infrastructural projects that are under construction such as the AKK (Ajaokuta-Kaduna-Kano pipeline project) and others,” the Shell boss stated.

He insisted that gas pricing must be bankable, stressing that the cost should not be high but should be adequate to spur investments in the sector.

“They’ve just released the price (for gas). I don’t want to cause any controversy, but that it is due for review in April. So we will be making our inputs to the authority to make sure the price is cost reflective. It is very important, because if it is not cost reflective it is going to involve a whole lot of things,” Okunbor stated.

Gas debts owed to gas producers in Nigeria have been a long-standing issue, hindering investments and impacting the overall growth of the gas sector.

A significant portion of the debt is considered legacy debt accumulated over several years due to various factors like payment defaults by power generating companies and inadequate gas pricing mechanisms.

The Federal Government launched the Gas Supply Stabilisation Fund in July 2022, which aims to ensure timely payments for gas supplied to the power sector by providing upfront funding to Gencos. This is seen as a positive step towards addressing the debt issue, according to operators.

2 Comments