The recent wave of core banking system upgrades across Nigeria’s financial sector has left many customers grappling with service disruptions and transaction failures. What started as a routine digital upgrade by Sterling Bank in early September has snowballed into an industry-wide phenomenon, with multiple banks, including Zenith, First Bank, and GTB, undergoing major system overhauls.

Sterling Bank was among the first to migrate, switching from the Switzerland-based Temenos T24 system to SeaBaaS, a locally developed solution by Peerless, on September 9, 2024. This unprecedented move marked Africa’s first indigenous core banking solution deployment, aimed at reducing the continent’s dependency on costly foreign software. However, the transition came with its challenges, as customers faced nearly two weeks of service interruptions, sparking complaints on social media platforms like X.

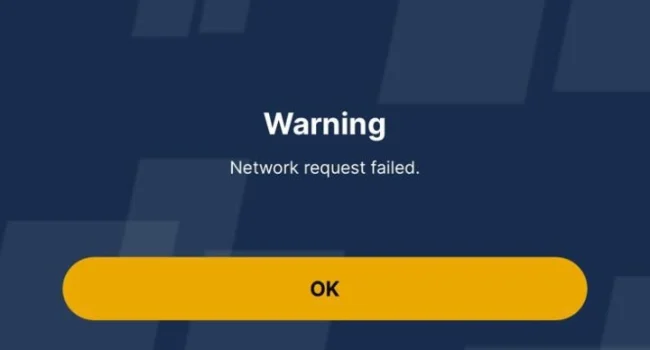

Zenith Bank followed suit, announcing an upgrade to its mobile banking platform on October 1. Although the bank promised the process would take just three hours, customers reported login issues that persisted for 72 hours, adding to growing frustrations. Similarly, First Bank’s upgrade caused a six-day blackout for its digital services, leaving customers stranded.

GTB and Access Bank joined the trend, with GTB announcing disruptions on October 13, 2024, as it migrated from ICS Financial Services to Finacle by EdgeVerve, an Indian software company. Although Access Bank postponed its system upgrade, GTB confirmed that its digital channels would be down for 11 hours.

The rush to upgrade is not merely coincidental. As Nigerian banks attempt to adopt cutting-edge technology and ensure the security of their systems, they are faced with the challenge of balancing innovation with customer satisfaction. Abubakar Suleiman, CEO of Sterling Bank, highlighted that African banks spend hundreds of millions of dollars annually on foreign systems, increasing pressure on trade balances. The move to SeaBaaS, he said, not only cuts costs but also boosts financial inclusion.

Despite the potential benefits, customers are demanding more transparency and smoother transitions. The Nigerian Financial Sector remains highly regulated, with the Central Bank of Nigeria (CBN), Securities and Exchange Commission (SEC), and the Nigeria Deposit Insurance Corporation (NDIC) overseeing operations. Financial experts assure that customers’ funds remain safe during these transitions, but the outages have raised questions about banks’ preparedness.

2 Comments