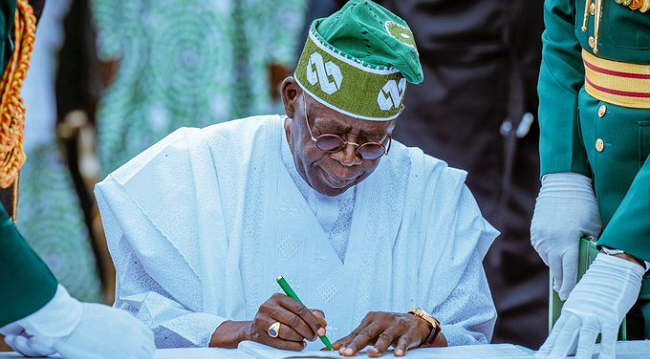

Radical tax reform bills proposed in the National Assembly could drastically reshape Nigeria’s funding landscape for tertiary education and scientific development. A review of the bills shows President Bola Tinubu’s administration is pushing to consolidate special tax privileges for agencies like TETFUND, NASENI, and NITDF, redirecting funds toward the Student Loan Fund.

Key Changes Proposed

The bills, set to expire the special privileges by 2029, will phase out current levies benefiting:

- TETFUND: Currently funded by a 3% tax on the assessable profits of Nigerian companies.

- NASENI: Funded by a 0.25% levy on profits before tax in key sectors, including oil and gas, telecoms, and aviation.

- NITDF: Receives 1% of the profit before tax of eligible companies.

From 2025, a unified development levy of 4% on profits will replace these levies, decreasing to 2% by 2027 and ceasing entirely by 2030.

New Allocations

- 2025-2026: TETFUND will receive 50% of the levy; the Student Loan Fund will get 25%.

- 2027-2029: TETFUND’s share rises to 66%, while the Student Loan Fund climbs to 33%.

- 2030: The Student Loan Fund will take the entire 100%, leaving TETFUND, NITDF, and NASENI excluded.

Impact on Key Agencies

TETFUND, responsible for over N800 billion in infrastructure funding for public tertiary institutions in 2024, will face significant cuts. NASENI and NITDF, critical for scientific and technological development, will lose their levies by 2027.

Chairman of the Presidential Committee on Fiscal Reforms, Taiwo Oyedele, has clarified that the agencies will not be scrapped. Instead, the government will approve direct funding for their operations, moving away from statutory transfers.

Public Reactions

The proposals have sparked opposition, particularly in Northern Nigeria, where Governor Babagana Zulum of Borno State has voiced concerns about their potential impact on education and development.

Despite reassurances from federal agencies, critics argue that the reforms could disrupt essential services provided by these agencies. Proponents, however, believe the consolidation will simplify tax structures and strengthen the Student Loan Fund.

With debates heating up in the National Assembly, the bills represent a bold attempt to redefine Nigeria’s approach to funding education and innovation.

2 Comments