Ahead of Wednesday’s sitting of the Supreme Court to decide on the naira redesign policy of the Central Bank of Nigeria (CBN), the Nigeria Governors’ Forum (NGF) has urged its members to support the legal battle on the policy against the Federal Government at the apex court.

In a communiqué issued yesterday, after its meeting on Saturday in Abuja, the NGF directed Attorneys General of the 36 states to review the suit at the Supreme Court with a view to consolidating the legal reliefs pursued by states.

The case was originally instituted by governments of Kaduna, Kogi and Zamfara states before Kano, Niger, Ondo and Ekiti states joined the suit last week.

Rising from the meeting, the governors said the country is at risk of recession, which will be the result of CBN’s naira exchange policy.

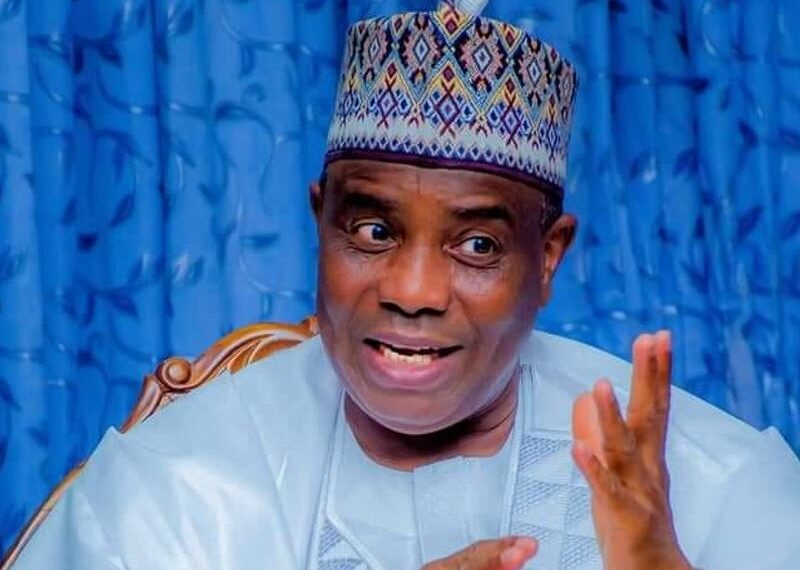

In the communiqué signed by NGF chairperson and governor of Sokoto State, Aminu Tambuwal, the governors, across party lines, criticised CBN over the handling of the policy, adding that the resulting naira scarcity is causing hardship for Nigerians.

They accused the apex bank of conducting a ‘currency confiscation’ programme that is causing suffering for Nigerians. The governors also called “for the halting of CBN’s plan to end the use of the old currency notes after two deadlines failed to end naira scarcity across the country.

“The argument by CBN for what it describes as the astronomical increase in the currency in circulation as the basis for this policy is not supported by its own data.

“According to CBN, the currency in circulation increased from N1.4 trillion in 2015 to N3.23 trillion in October 2022. CBN appears not to have taken into consideration the increase in the size of the country’s nominal GDP over this period, the doubling of consumer prices, rising population and the impact of the humongous Ways & Means advances to the Federal Government by CBN over this period.

“In the circumstances, it is safe to draw either of two conclusions – the CBN data may be incomplete or in fact, Nigerians may have done exceptionally well in the transition to a cashless economy.

“In addition, considering the sizeable informal sector in the nation, the amount of banknotes created in exchange so far by the CBN implies it vastly underestimated the economy’s actual cash needs.

“The inability to use the new notes has had far-reaching economic effects, leading to the emergence of the naira black market, severe food inflation, variable commodities prices based on the method of exchange, and long queues as well as crowds around Automated Teller Machines (ATMs) and banking halls across the country. The country runs the risk of a CBN-induced recession.

“It is our considered view that what CBN is at present pursuing is a currency confiscation programme, not the currency exchange policy envisaged under S20(3) of the CBN Act, 2007. Currency confiscation in the sense that the liquidity provided to the general public is grossly insufficient due to the restrictions placed on the amount that can be withdrawn regardless of the amount deposited.”

The governors’ stance comes amid suffering by Nigerians who have found it difficult to access cash for their daily transactions. The currency scarcity is a product of CBN’s decision to redesign the notes of the three largest naira denominations: N200, N500 and N1,000.

The governors, therefore, “called on the Federal Government and CBN to respect the rule of law and listen to the voice of reason expressed by Nigerians and other stakeholders, including the Council of State, before the damage to our economy becomes too great to fix by the next administration.”

As the controversy over the naira redesign continues, Ekiti State government, at the weekend, applied to be joined as co-plaintiff in the suit against the Federal Government over CBN deadline for the swap of old notes for new ones.

According to a statement by the Chief Press Secretary to the governor, Yinka Oyebode, the Application for Joinder was filed on Friday at the Supreme Court by the Ekiti State Attorney General and Commissioner for Justice, Mr. Dayo Apata (SAN).

The suit with number SC/CV/162/2023 has Attorneys General of Kaduna, Kogi and Zamfara states as plaintiffs, while the Attorney-General of the Federation, Abubakar Malami (SAN) is the defendant.

Also at the weekend, Niger State government filed a suit against the Federal Government over the implementation of the CBN policy. A statement by the Attorney General and Commissioner for Justice, Nasara Danmallam, said the suit with number SC/CV/210/2023 was filed on Friday.

According to the statement, the suit is seeking for an extension of the timeframe given by CBN for the currency swap and withdrawal from circulation, of the old notes among other reliefs.

Danmallam added that in the affidavit in support of the originating summons, Niger State government contended that unavailability of the newly redesigned notes has caused untold hardship and suffering on citizens of the state, especially those living in rural communities.

MEANWHILE, the Chartered Institute of Bankers of Nigeria (CIBN), yesterday, said the financial institution in the country is working hard to restore normalcy to prevailing challenges confronting the sector. President/Chairman of Council, CIBN, Ken Opara, in a release, reassured the public that the banking industry remains very sound and safe.

The reassurance is coming in the face of challenges posed by the naira redesign. “The soundness of the banking industry has been reaffirmed severally by CBN, which is the only body best suited to assess the health of the financial industry in Nigeria. In view of this, the apex bank has debunked insinuation that it plans to shut down some deposit money banks.

“We equally like to allay the fears around the shortage of materials for printing the new naira notes, which CBN has also discredited. The Nigeria Security Printing and Minting (NSPM) Company, said it has made adequate arrangement to continuously produce redesigned naira notes as well as other denominations,” he said.

He implored the public to disregard any contrary information as the entire banking community remains focused, committed, and working round the clock to address all the contending issues with a view to restoring normalcy.

HOWEVER, lack of infrastructure and technical challenges have been described as obstacles to the adoption of CBN withdrawal limit directive.

For over a decade, CBN introduced the cashless policy to limit the circulation of physical cash and promote electronic modes of payment in the country.

On December 6, 2022, CBN issued a new directive to financial institutions, stipulating that over-the-counter cash withdrawals by individuals and corporate entities should not exceed N100,000 and N500,000 (per week) respectively and that the amount of cash that can be withdrawn at ATMs and PoS terminals should not exceed N20,000 per day and N100,000 per week.

In a nationwide survey conducted by Market Trends International (MTI) among stakeholders to gauge opinions and understand the perception of the average Nigerian regarding this directive, 59 per cent of the respondents considered it to be bad, while 41 per cent of those who responded said the restriction of cash transactions will gradually heal an ailing currency, as well as reduce the risk of money laundering.

According to the Executive Director of Market Trends International, Victor Ebhomenye, “we probed further to decipher the motives behind respondents’ viewpoints by trying to understand the reasons such assertions were held. A good chunk of the respondents who indicated the policy to be good believe the directive promotes cashless policy, a goal CBN has relentlessly pursued within the past 10 years in a bid to promoting financial inclusion, tackle corruption, and prevent money laundering, ultimately becoming of immense benefits to Nigerians.

“Majority of the opposing respondents indicated that the directive will affect the business activities of rural dwellers, rightly so as a result of the lack of access to financial services within the rural community. They also believe that unskilled workers, who happen to be an integral part of the workforce will be affected. The directive makes it difficult to move the daily bulk of cash used for the payment of their daily wages.”

Comparing and contrasting the pros and cons of the directive, Ebhomenye said: “It can be likened to a double-edged sword, favouring one set of people, while obstructing another cluster of individuals at the same time. Whichever edge of the sword is used, it is pertinent that CBN takes into consideration the plight of the masses when implementing this directive, keeping in mind that they are the majority mostly affected.’’

Quoting EFiNa Access to Financial Services report in 2020, he said that only 45 per cent of the Nigerian adult population has access to financial services, leaving well over half of the adult population without access.

This, he said, makes it difficult to implement a cashless policy considering obvious loopholes inhibiting the policy from thriving.

BUT the major opposition Peoples Democratic Party (PDP) has called on APC leaders, including Tinubu and APC governors to “immediately release billions of new naira notes in their custody and halt the anguish being experienced by Nigerians.”

PDP said it is “wicked and unpardonable that the same band of deceptive, sneaky and hypocritical APC leaders who are deeply involved in intercepting and hoarding of new Naira notes are going about trying to hoodwink Nigerians by posturing as though they are concerned about their plight.”

The opposition party, in a statement by its national publicity secretary, Debo Ologunagba, stated that “the controversial naira redesign and swap policies are programmes of the APC administration, which is also completely in control of the production and circulation of the new notes.

“The APC leaders having realised that they cannot win in the 2023 general elections, sabotaged the system and diverted the new notes so as to create widespread social unrest to justify their plan to derail the elections and truncate our democracy.” the PDP claimed.

“Our party has been informed by some well-meaning APC members on how six APC governors are coordinating the hoarding of new naira notes for the vote buying scheme of APC ahead of the February 25 presidential election.

“It is callous for APC leaders to continue to watch Nigerians spend nights at ATM stands, fight one another in bank halls and ATM centres for cash with millions stranded without money to take care of their daily needs.”

2 Comments