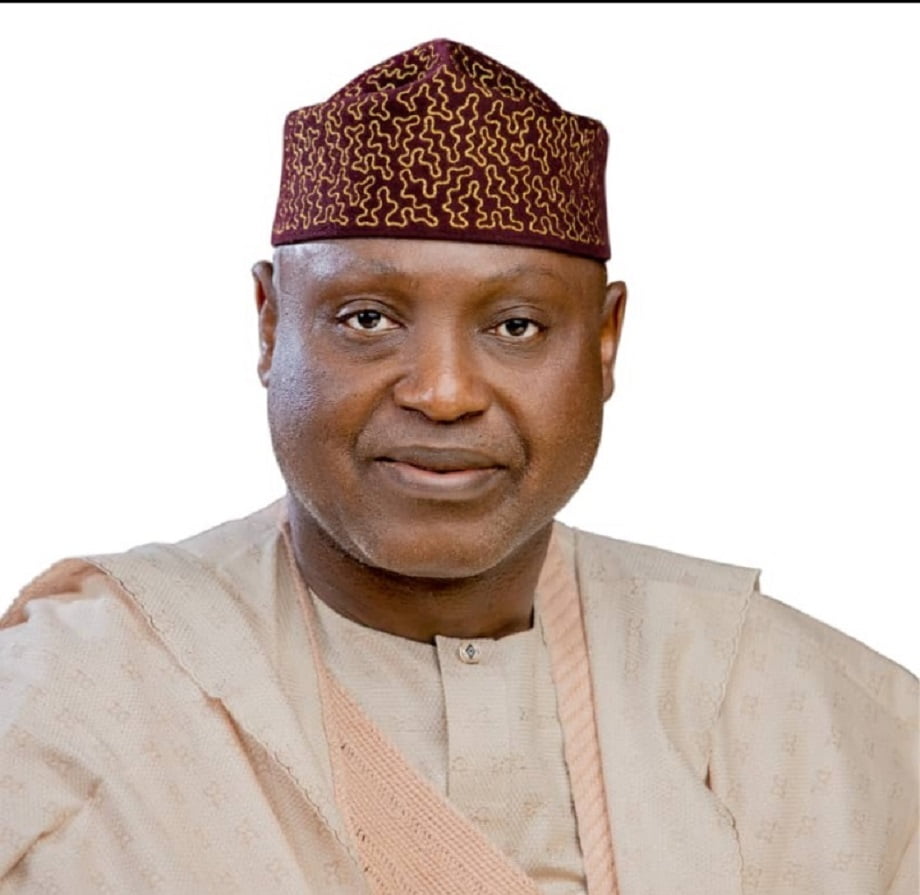

The long-anticipated student loan programme is set to launch this Friday, benefiting 1.2 million students across federal tertiary institutions in Nigeria, according to Akintunde Sawyerr, Managing Director/CEO of the Nigeria Education Loan Fund (NELFUND).

Speaking at a pre-application sensitisation press conference in Abuja on Monday, Sawyerr announced that the first phase of the programme will include students from federal universities, polytechnics, colleges of education, and technical colleges. Data from the National Universities Commission indicates there are 226 federal tertiary institutions: 62 universities, 41 polytechnics, 96 monotechnics, and 27 colleges of education.

The programme follows President Bola Tinubu’s signing of the Student Loans (Access to Higher Education) Act (Repeal and Re-Enactment) Bill, 2024, into law on April 3. This act, which repeals the previous Student Loan Act of 2023, was enacted to provide loans to Nigerian students for higher education, vocational training, and skills acquisition.

The new law eliminates the family income threshold, allowing students to apply for loans and assume responsibility for repayment according to NELFUND guidelines. The aim is to ensure no Nigerian, regardless of their background, is excluded from obtaining quality education.

Initially set to launch in September, the programme faced several delays due to an expansion directive from President Tinubu to include loans for vocational skills. The Nigerian Education Loan Fund later announced that the application portal would open on May 24.

Sawyerr urged students from federal tertiary institutions to visit the website www.nelf.gov.ng to apply starting May 24. He noted that students from state universities and vocational skills centres would be eligible to apply at a later date. Requirements for the application include an admission letter from the Joint Admissions and Matriculation Board, National Identity Number, Bank Verification Number, and completed application forms from the NELFUND website.

The loan application process has been designed to be user-friendly, ensuring easy access for all eligible students. Online support will be available to assist applicants with any questions or concerns. A key feature of the programme is the elimination of physical contact between applicants and NELFUND.

“We believe that education is a vital investment for the future. The student loan initiative of Mr President is a testament to this commitment,” Sawyerr stated.