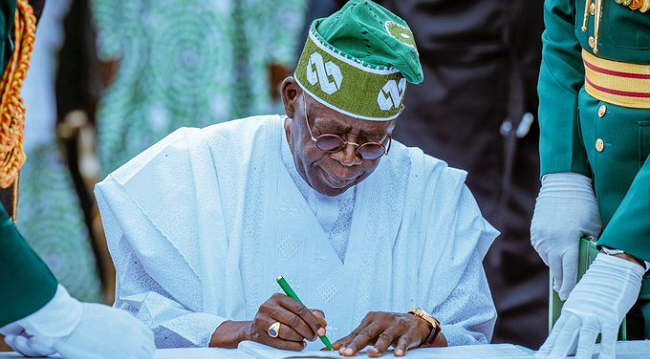

President Bola Tinubu has formally requested the National Assembly’s approval for a new external borrowing plan amounting to N1.767 trillion. This loan is intended to partially finance the substantial N9.7 trillion deficit outlined in the 2024 budget. The president’s proposal was presented during the plenary session on Tuesday.

In addition to the borrowing request, President Tinubu submitted the Medium-Term Expenditure Framework and Fiscal Strategy Paper (MTEF/FSP) for 2025-2027. He also introduced an amendment bill aimed at establishing the National Social Investment Programme, which seeks to designate the social register as the primary tool for implementing federal social welfare initiatives.

This development comes against the backdrop of escalating debt servicing obligations. Recent data from the Central Bank of Nigeria (CBN) reveals that the federal government expended $3.58 billion on foreign debt servicing in the first nine months of 2024. This figure represents a 39.77% increase from the $2.56 billion spent during the same period in 2023.

A detailed breakdown of the CBN’s international payment statistics indicates significant fluctuations in monthly debt servicing payments throughout 2024:

- January: Payments surged by 398.89% to $560.52 million, up from $112.35 million in January 2023.

- February: A slight decline of 1.84% was observed, with payments decreasing to $283.22 million from $288.54 million in February 2023.

- March: Payments dropped by 31.04% to $276.17 million, compared to $400.47 million in March 2023.

- April: A substantial increase of 131.77% was recorded, with payments rising to $215.20 million from $92.85 million in April 2023.

- May: The highest monthly payment of the year was made, totaling $854.37 million—a 286.52% increase from $221.05 million in May 2023.

- June: Payments declined by 6.51% to $50.82 million, down from $54.36 million in June 2023.

- July: A 15.48% reduction was noted, with payments amounting to $542.50 million, compared to $641.70 million in July 2023.

- August: Payments decreased by 9.69% to $279.95 million, down from $309.96 million in August 2023.

- September: An increase of 17.49% was observed, with payments rising to $515.81 million from $439.06 million in September 2023.

These figures underscore the mounting pressure of Nigeria’s foreign debt obligations, exacerbated by fluctuating exchange rates.

Further complicating the fiscal landscape, the total debts of Nigeria’s 36 states have risen to N11.47 trillion as of June 30, 2024. This marks a 14.57% increase from the N10.01 trillion recorded in December 2023. External debt for the states and the Federal Capital Territory (FCT) also climbed from $4.61 billion to $4.89 billion during this period. In naira terms, this represents a 73.46% increase, influenced by the devaluation of the naira from N899.39/$1 in December 2023 to N1,470.19/$1 by June 2024. Conversely, domestic debt for states and the FCT declined from N5.86 trillion to N4.27 trillion.

The Debt Management Office (DMO) reports that states and the FCT accounted for a portion of Nigeria’s public debt, which stood at N134.3 trillion in June 2024. This reflects a decrease from their 10.29% share in December 2023, despite the nominal increase in debt levels.

Analysts have expressed concerns over the states’ persistent reliance on borrowing to finance their budgets. The total debt stock of the 36 states surged by 38.1%, from N7.25 trillion in 2022 to N10.01 trillion in 2023. This growth was partly driven by a N606.12 billion increase in domestic debt, resulting in an average year-on-year growth rate of 11.4%. By December 31, 2023, the total domestic debt stood at N5.86 trillion.

The situation is further complicated by rising foreign debt, which increased by 4.1%, from $4.43 billion in 2022 to $4.61 billion in 2023. The liberalization of the exchange rate has exacerbated the financial strain on states, significantly raising their foreign loan repayment obligations in naira terms. Lagos State remains the most indebted in foreign currency, accounting for 26.9% of the total foreign debt, equivalent to $1.24 billion.

A recent report by BudgIT highlights that 32 states relied on the Federation Account Allocation Committee (FAAC) for at least 55% of their total revenue in 2023. The report emphasizes the over-reliance of state governments on federally distributable revenue, making them vulnerable to crude oil-induced shocks and other external factors.

In the 2023 fiscal year, the combined revenue of all 36 states increased by 31.2%, from N6.6 trillion in 2022 to N8.66 trillion. This growth rate exceeded the previous year’s increase of 28.95%, indicating a notable improvement in fiscal performance. Of the total revenue generated in 2023, Lagos State contributed N1.24 trillion, representing 14.32% of the cumulative revenue of the 36 states.

Gross FAAC allocations grew by 33.19%, from N4.05 trillion in 2022 to N5.4 trillion in 2023, contributing to 65% of the year-on-year growth of the combined revenue of the 36 states. The report notes that 14 states relied on FAAC receipts for at least 70% of their total revenue. Additionally, transfers to states from the federation account comprised at least 62% of the recurrent revenue of 34 states, excluding Lagos and Ogun. Furthermore, 21 states relied on federal transfers for at least 80% of their recurrent revenue.

These findings underscore the critical need for states to diversify their revenue sources and reduce dependence on federal allocations to enhance fiscal sustainability and resilience against economic shocks.

2 Comments