The Federal Government of Nigeria has commenced the deduction of a N50 levy on electronic money transfers of ₦10,000 and above conducted via financial technology (fintech) platforms, including Opay, Moniepoint, Kuda, and others. This levy, known as the Electronic Money Transfer Levy (EMTL), is part of the provisions of the Finance Act 2020.

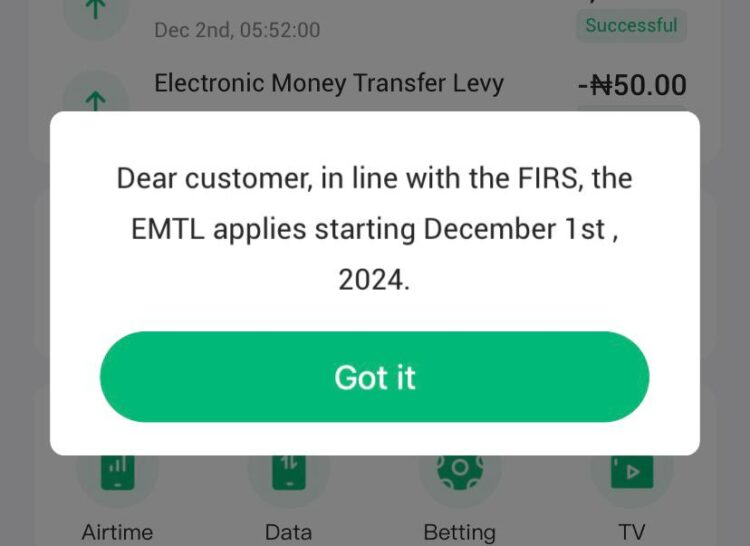

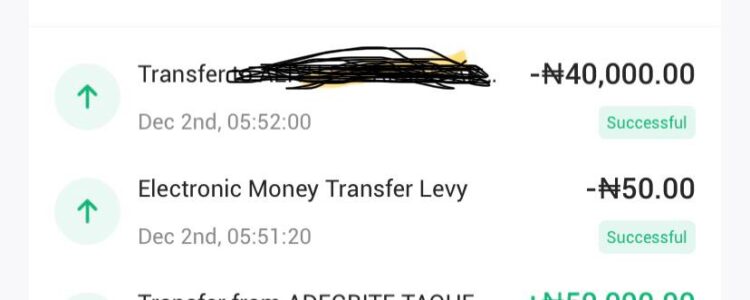

Effective December 1, 2024, the EMTL requires recipients of electronic transfers of ₦10,000 or above to pay a one-off levy of ₦50, remitted directly to the Federal Inland Revenue Service (FIRS). Fintech firms have clarified that the levy does not benefit them but is solely a government initiative.

Widespread Opposition and Implementation Challenges

The introduction of the EMTL has drawn criticism from various quarters, including the National Association of Nigerian Students (NANS), which called for its reversal, citing the financial strain on Nigerians already grappling with economic challenges.

Despite the backlash, fintech firms have started implementing the levy. Opay, in a notice to its users, stated:

“From December 1, 2024, a one-time charge of ₦50 will be applied to electronic transfers of ₦10,000 and above in compliance with FIRS regulations. Opay does not benefit from this charge, as it is entirely directed by the Federal Government.”

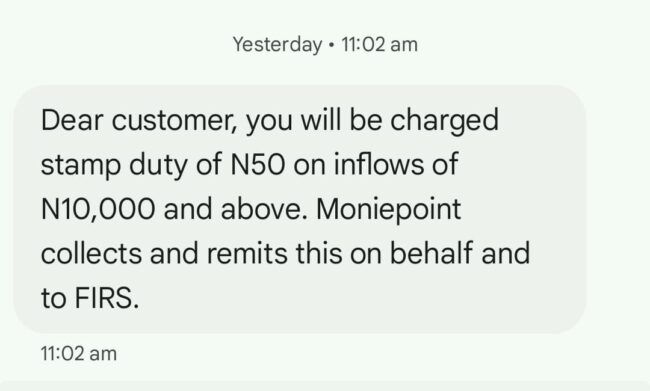

Similarly, Moniepoint informed its customers:

“Dear customer, you will be charged a stamp duty of ₦50 on inflows of ₦10,000 and above. Moniepoint collects and remits this on behalf of the FIRS.”

Fintechs Caught Between Compliance and Customer Backlash

The implementation of EMTL has placed fintech platforms in a delicate position. While obligated to comply with FIRS directives, they have had to address growing customer dissatisfaction. Many users argue that the levy adds to the financial burden of everyday transactions, particularly as electronic payment systems have become the backbone of commerce in Nigeria.

Calls for Policy Review

Critics argue that while the EMTL may boost government revenue, it risks undermining the progress made in financial inclusion and the adoption of digital payment systems. Economists and advocacy groups have urged the government to reconsider the levy or provide alternative solutions that alleviate the strain on consumers.

2 Comments